An interview with Gabrielle Inzirillo, Director, Fintech, Plug and Play Center

A few years back, everyone seemed to be sporting the latest hackathon T-shirt, bracing themselves for the onslaught of PSD2 in the EU, or a similar directive by the Competition and Markets Authority in the UK. Experts would warn banks not to see fintech as a them-and-us scenario, yet the thought of having to open one's platforms for new entrants was not a happy one to many in the industry.

Add to this an apparent lack of trust after the credit crisis in 2007, with many incumbents getting caught up in the idea that fintech was going to create new customer experiences and disrupt everything:

"Do you remember those polls in the media some years ago saying no one trusted their bank anymore? People would say: fintech is a new thing that is going to change our jobs or even put us out of work. What happens when there's a slight sense of distrust and the media is blowing things out of proportion? Well, what really happened was that a lot of people working in the financial industry suddenly found themselves out of work after the credit crisis," Gabrielle Inzirillo, Director, Fintech, at Plug and Play Tech Centre, explains.

This pool of talented people, who had been laid off from the financial industry, started systematically going after a small segment of the pie, Inzirillo explains, making fintech synonymous with start-ups although the coupling of financial services and technology had in fact been around for decades.

Everyone was sexier

The many newcomers seemed to strike terror in the hearts of financial institutions:

"They were cleverer, they could do it faster, and they were all going to nit-pick it off, practically a bunch of vultures coming in. From 2010-15, that's all they were talking about: fintechs going to disrupt banking as we knew it. With a potential to do things better than banks, they were going to take away our jobs, all our services. They were sexier, they had better logos. And they had all these core focuses – it was all about: why give your money to the banks when they're not even going to invest it properly? Give it to us, and we'll invest it in robots, in machine learning," Inzirillo, who worked in London and Miami at the time, reminisces.

But three years down the line, for every new start-up there would now be two or three competitors, or even 25, in the same space, only with a different logo. And suddenly it was not so much about the bank being disrupted anymore:

"Let's look at it as consumers. Instead of me going to the HSBC, I'm expected to do a due diligence on every start-up. Say, every time I'm going to send money to someone, I'm going to look at everyone who can do that same thing. Do you expect the consumers to curate their life in such a way that they're happy to go and build their own bank with offerings from different service providers? I can't do it, and I'm literally in the field," Inzirillo points out.

Consumers want a one-stop shop

According to her, consumers soon realised that the deconstructed financial market was unsustainable, which again led fintechs and financial institutions to take a different approach:

"We're seeing a shift in that the customer cannot have the mental load of knowing all partners out there. It's also true for the partners they work with – retailers, corporates – they all want a one-stop shop," Inzirillo points out, adding that, if they are not going to build it in-house, some of the newer banks will seek the right fintech partners so as not to leave their customers to fend for themselves:

"Whereas the idea before was essentially everyone nit-picking everything off, now everyone's rebundling," Inzirillo explains, citing German direct bank N26 as an example of a newer bank bundling fintech solutions.

They are not moving

She is not blind to the fact that start-ups, not least in the States, have matured greatly, raising the question of what banks are doing in the field if they are no longer looking to connect with small players:

"Honestly, they don't see them as a menace anymore. Why? Because people aren't cutting out their banks. 5-6 years ago, they said people were going to move all their money away. Well, it hasn't happened. Last year in the US, only 4% of people changed banks, and the majority was not to new banks or fintechs, they just went to a bank that had a good point-of-sale service or a good opening offer. The threat of them moving becomes unsubstantial," Inzirillo asserts.

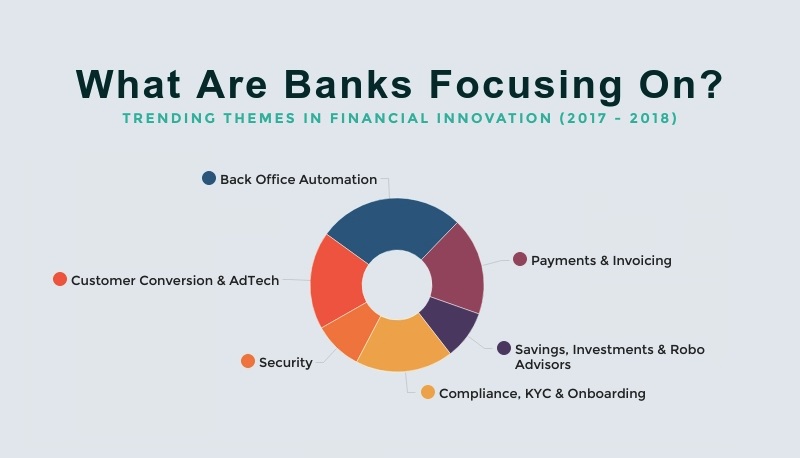

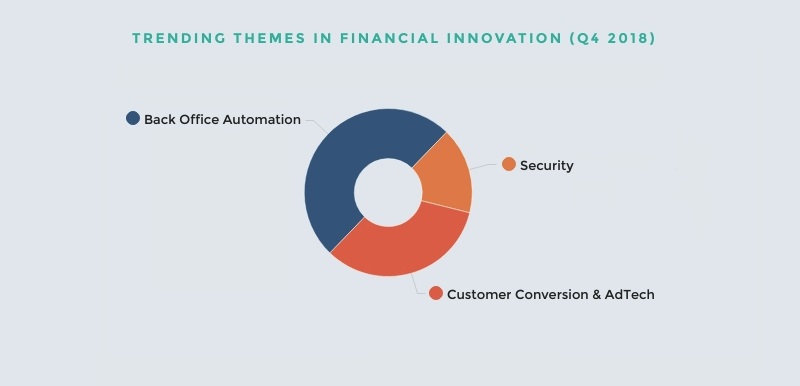

Instead, during 2017 and 2018, banks' focus changed dramatically. Plug and Play data show how in 2017, topics preoccupying banks' minds would be manifold, whereas just two years later, they had boiled down to just three segments.

Throughout 2017 and 2018, banks were preoccupied with a large number of topics (source: Plug and Play Tech Centre)

By late 2018, only three topics remained (source: Plug and Play Tech Centre)

Essentially, what Plug and Play's data show is that financial institutions no longer see fintechs as a major threat:

"They no longer believe the claim that new algorithms are going to change their game and they remain cautious when analysing new RegTech solutions. The promises of the last few years that 'integrate this and it's going to cut your back-office costs by X million', have proven to be far more complex to achieve than initially anticipated. It's just a fact: fintech as we currently understand it, hype and all, is in fact dead. Banks and FIs are back to looking to help their core business.

They're back to basics. The threat of the fintechs coming to take over everybody's job is done, finished. Now it's all about solution selling and driving revenue and if start-ups can help with that, then so be it, the banks are listening," Inzirillo concludes. She remains optimistic that the next few years will see a convergence of start-ups that don't necessarily fall under the 'fintech' label achieving successful partnerships with financial institutions.

She is backed by a recent PWC study showing that German banks are lagging behind in terms of reaching medium-term equity targets, leading the consultancy firm to advise banks to sell more and higher-margin products to their existing customer-base rather than trying to gain market share and keep costs low – a common strategy for European banks to counteract decreasing turnover and profits.

Source: Frankfurter Allgemeine Zeitung

Read more: https://www.nets.eu/perspectives/Pages/Banks-need-to-see-fintech-as-a-mindset.aspx