Paying the utility bills is no joking matter, and the Danish and Norwegian consumer tends to pay his or her bills sitting at a desk. Anxiety levels peak just before initiating the payment, making two-factor authentication a welcome disturbance as it serves to underline the seriousness of the situation and how things are taken care of and put in order. A bit like ticking a box.

New insights challenge the traditional understanding in the financial industry of how consumers perceive money and payments. According to a 2017 ethnographic study carried out among 21 Danish and Norwegian end-user respondents, consumers do not differentiate between recurring and one-off payments. Rather, they make an almost unconscious distinction between commitment money and aspirational money, dividing their personal spending into necessities and leisure spending.

A universal approach to money

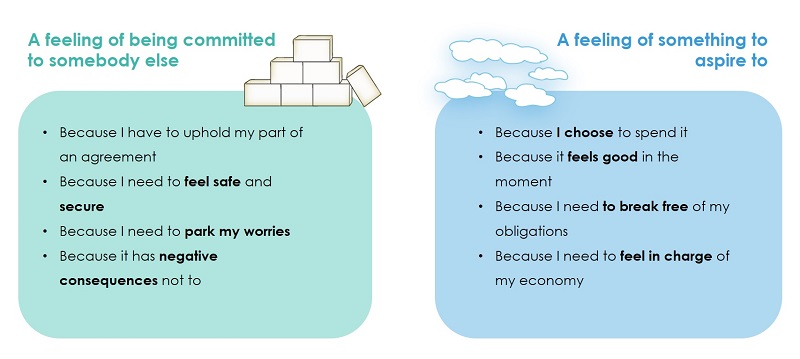

Commitment money covers the financials that must be dealt with in order to maintain one's current standard of living and ensure it will be of a sufficient quality in the years to come:

"It's a basic human need to keep yourself and your loved ones safe and secure. Being able to predict upcoming bills and keep track of your expenses provides security and establishes peace of mind, and the level of care and effort put into the situation allows the person to leave his or her worries aside," explains Dorte Ransby, Senior Vice President, Corporate Services at Nets.

Aspirational money, on the other hand, covers money which is 'nice to have', allowing consumers to make choices that add value to their life – a life in which stability has been ensured with commitment money. Aspirational money forms identities and enables relationships and experiences.

Typically, when spending aspirational money to treat oneself, the experience will be in focus:

"When you need to consciously deal with money, it interrupts the flow and the intuitive mindset of the consumer. This is where seamless payment methods have a place, allowing the consumer to pay for the goods without bursting their bubble," says Dorte Ransby.

You feel committed to someone else when paying your utility bills, whereas you have a feeling of aspiration when spending money on non-essentials.

The pain of spending money

Spending money is associated with pain, but curiously, the study clearly demonstrates how anxiety levels peak at different stages depending on whether the consumer is paying the bills or merely spending money on fun.

When paying necessities, anxiety sets in right at the outset, reflecting a feeling of wanting to get the payment over with. Anxiety levels lower as the transaction is handled and verified, and afterwards, the payer will feel safe, secure and relieved, able to let go and think about something else. This has created a demand for payment set-ups that ensure the automatic payment of recurring bills.

The almost opposite happens when aspirational money is spent. The shopping spree begins with a slight feeling of doubt: 'Do I want to spend this kind of money?' and a need to feel secure and assured that the money is there. When paying, pleasure and self-indulgence become the overriding emotions, establishing a need for the payment to take place without being interrupted by money concerns. Soon after, anxiety sets in, as a feeling of guilt may arise along with the sense that it may have been wiser not to have spent the money:

"At this stage, the consumer needs reassurance that he or she hasn't spent too much and, in both scenarios, needs a quick overview of his or her personal finances and disposable amount," underlines Dorte Ransby.

Two cognitive tracks

The distinction between commitment and aspirational money is found across demographics and types of personality. However, the way funds are divided into the two categories depends on the individual's disposable income. What may seem a luxury to one person, such as a gym membership, may be perceived as a necessity to the next, as they cannot imagine a life that does not include going to the gym regularly. Life circumstances and personal financials thus influence the perception of whether an item is 'need to have' or 'nice to have'.

How the individual deals with commitment money and aspirational money is thus driven by different basic emotions and needs – a notion similar to the one described by economist Daniel Kahneman in his best-selling book 'Thinking, Fast and Slow' from 2012.

Central to Kahneman's thinking is the division of the thinking mind into two modes: System 1 is fast, instinctive and emotional, whereas System 2 is slower, more deliberative, and more logical. While System 1 allows you process information and react instinctively, for example when completing a phrase such as 'War and ….,' solving 2+2=? or localising the source of a specific sound, System 2 will enable you to brace yourself before the start of a sprint, dig into your memory to recognise a sound or park in a tight parking space. It will also allow you to determine the validity of a complex logical reasoning. Needless to say, the latter mode of thinking is employed when handling commitment money.

'Thinking, Fast and Slow' was published in 2011 by Nobel Memorial Prize in Economics laureate Daniel Kahneman. In 2012, it was the winner if the National Academies Communication Award for best creative work that helps the public understanding of topics in behavioral science, engineering and medicine.

Challenges the industry to think in new ways

The findings of the study make it evident that the two states of mind commitment and aspirational match poorly with traditional categories such as 'one-off payments' and 'recurring payments' prevalent in the financial industry. This insight offers great opportunities for players able to design services that can distinguish between the two states of mind and cater to them.

The insights into customers' states of mind could also benefit other industries, allowing them to optimise the user experience in sales situations. Gathering information about customer behavior and preferences will help make the experience stand out and adapt the user design to match the customers' state of mind when having to part with their money.