The Nordic fintech scene is a young and dynamic one with a majority of companies in their start-up phase. Out of some 250 start-ups, 60% were established less than six years ago and 40% employ fewer than five people, according to a recent study undertaken by Oxford Research on behalf of Nets.

"The Nordic fintech scene is an exciting place to be right now, with a vibrant start-up environment attracting a high proportion of venture capital investments in Europe," says Simon Buchwaldt-Nissen, Corporate Strategy at Nets, who was surprised by the number of Nordic fintechs unveiled by the study.

When Nets set out to gain an overview of the Nordic fintech community, the list counted some 250 businesses. Very soon, however, the number reached 400, reflecting the many newcomers to the scene.

By comparison, a parallel survey uncovered 110 fintechs in the Baltic region while Germany had 433 fintechs in 2016, according to the German Federal Ministry of Finance, suggesting that the Nordic fintech environment is both vibrant and fertile. Interestingly, the findings also show that, despite a pioneering spirit, fintechs tend to stick to their home turf. Over 90% of respondents indicate a market appetite confined to their local region.

Payments attract the most attention

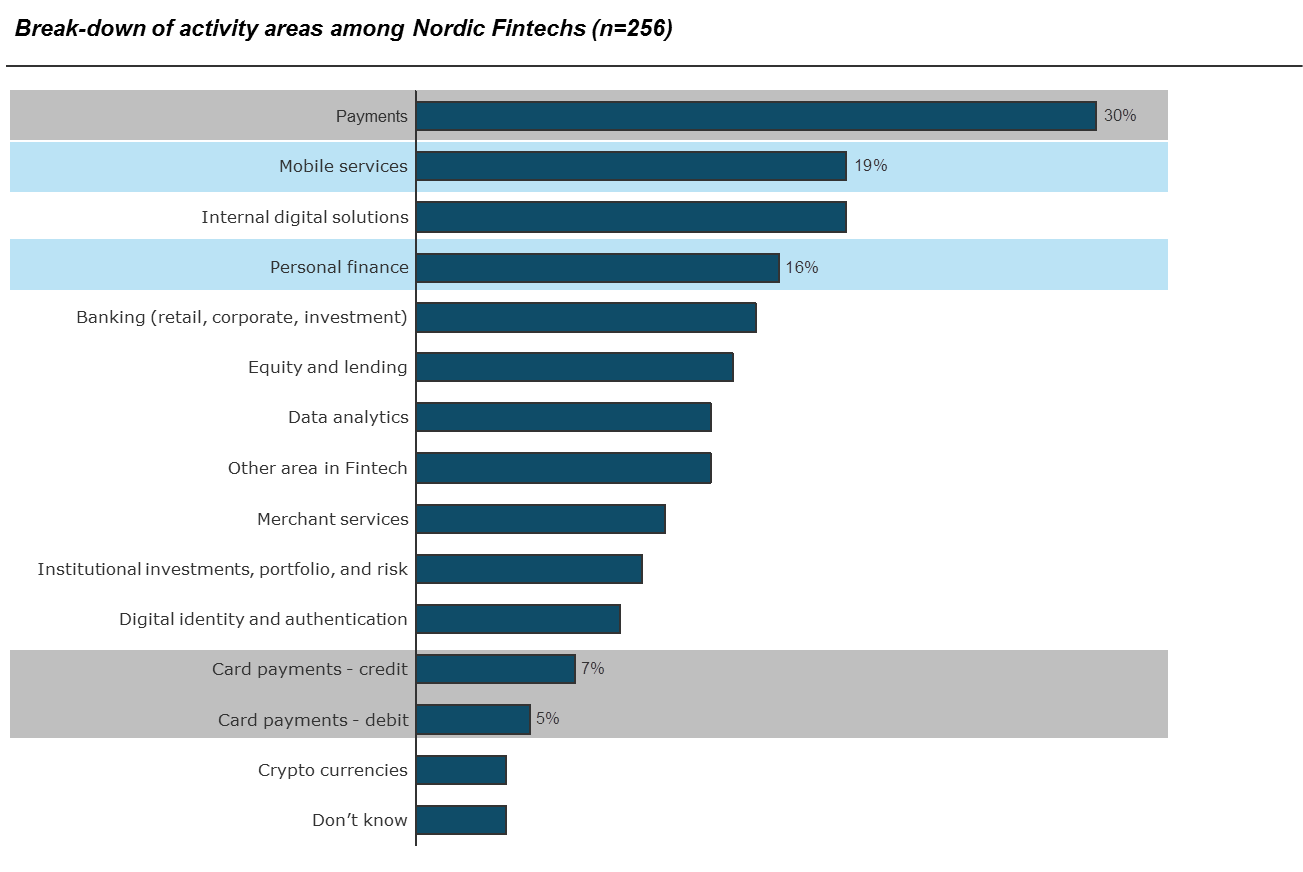

The study revealed that just shy of half of the 250 Nordic fintechs in the survey focus on payments, while nearly 40% of them provide mobile services such as personal financial management.

Nordic fintechs attract venture capital

Many of the businesses in the survey show positive traction and have managed to secure external funding:

"Fintechs often employ new business logics, potentially making them valuable innovation partners to more established players like ourselves. We have actively sought to identify fintechs in our footprint in order to engage with the most promising ones, with a view to co-create and innovate exciting new digital payment methods or value-adding services ," explains Simon Buchwaldt-Nissen.

He points out that 75% of the Nordic fintechs participating actively in the the study, through in-depth questions, had received external funding over the past 24 months. In Sweden and Finland the number was 85%. The projection for investments in Nordic fintechs was set to reach some 185 million euros in 2016, equivalent to a year-on-year growth rate of about 50% (Deloitte: 'Fintech in the Nordics 2016').

Co-creation teaches companies new ways of working

Late 2016, less than six months after Nets announced the launch of its Blockchain Lab, the first proof of concept was completed in the shape of a blockchain-based 'mortgage service'. The proof of concept demonstrates the ability to record documents associated with buying and selling a house.

"Collaboration with fintechs has taught us a lot, paving the way for new ways of working," says Simon Buchwaldt-Nissen enthusiastically, underlining the value of openness, co-creation and creativity to a business like Nets. "We want to be an innovation leader working together with our customers and strategic partners to co-create solutions that can be seamlessly integrated with third parties, " he concludes, welcoming the idea of Nets opening up to partnerships.

As a founding partner of the Copenhagen Fintech Lab and through its partnership with SingularityU Denmark and Oslo's Fintech Factory, Nets is no newcomer to the world of fintech. Having explored the Nordic fintech scene, the company is now on the look-out for the right fintech partnerships throughout the payment value chain, in which both parties will be able to accelerate their core business.

Read about Nets' approach to Fintechs here.