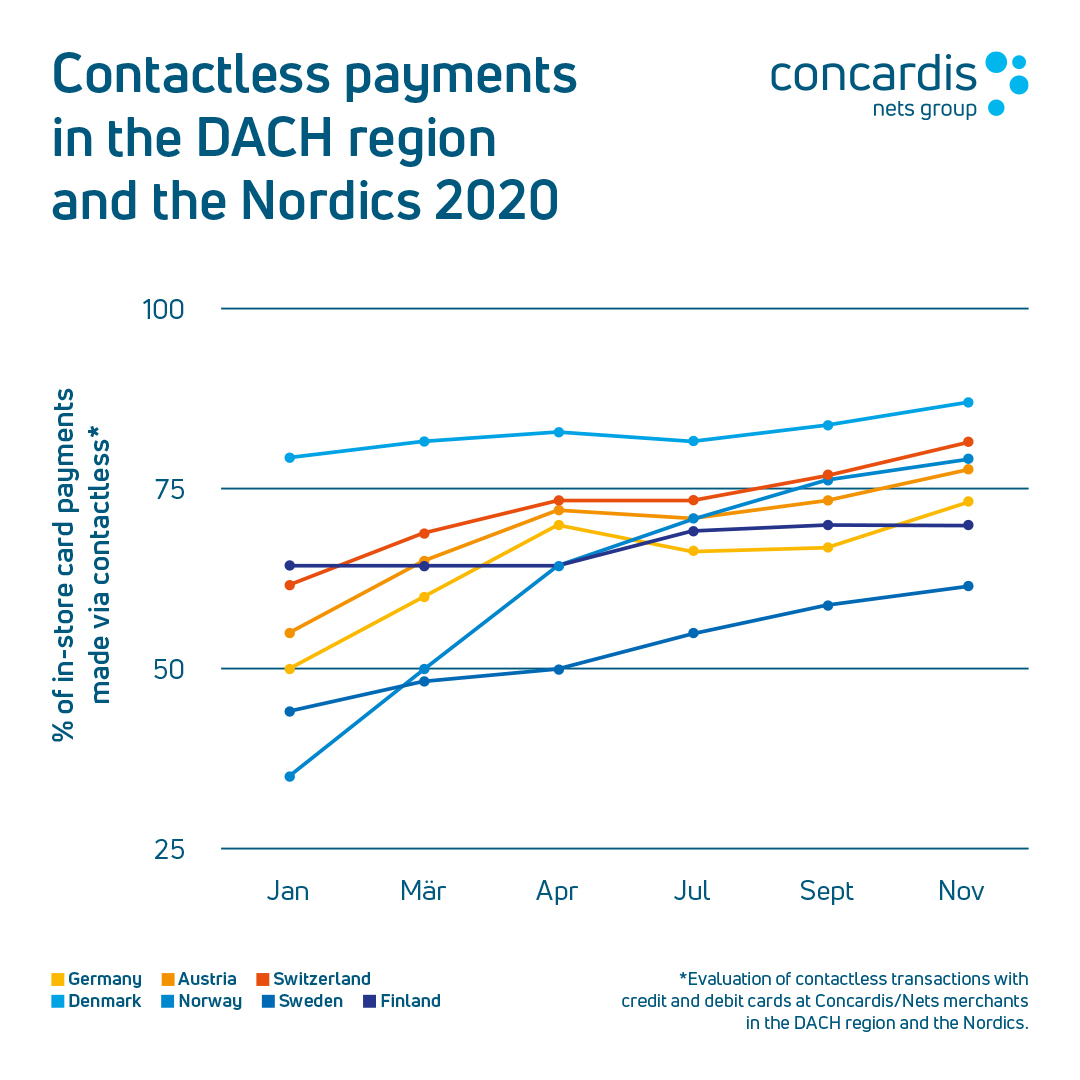

The latest analysis of payment card transactions processed by Nets on behalf of their merchant customers shows that consumer behaviour in Europe has changed dramatically in recent months. If we take the ratio of contactless payments as a reference value, the Scandinavian region and the German-speaking countries have reached a very high level. Today contactless payments by card or smartphone constitute between 61 and 87 percent of all in-store payments. But not only is the share of transactions via NFC increasing, in some cases the proportion of sales has also doubled.

New contactless records

During the pandemic contactless payment also established itself firmly in the DACH region after the first state-ordered lockdown measures were relaxed. The trend is still positive and in Germany for months now a constant 70 percent of payments have been made contactless. In November the rate in Germany reached a new record level of 73 percent. In the same month there were also new highs in contactless payments of 77 percent in Austria and 81 percent in Switzerland.

In the Nordic countries contactless payment also rose significantly during the pandemic – from an average of around 56 per cent across all countries at the beginning of the year to 74 per cent in November. In Denmark contactless payment ratio today is a solid 87 percent, putting the country in the lead in the overall country rankings. In Norway the proportion rose from just 35 per cent in January to a remarkable 78 per cent in November and is now even higher than in Finland (70 per cent) and Sweden (61 per cent).

A rapid change from cash to digital payments

"We see a fast-developing digitisation trend here and are therefore at a turning point in European payments," says Hoffmann. An evaluation by the European Central Bank (ECB) published at the beginning of December shows that at the end of 2019, at 73 percent, cash was still the most frequently used means of payment in the euro area, especially for smaller amounts at the shop checkout, but it is steadily losing importance. In terms of sales volume, 48 percent have already paid more cashless than with coins or bills. In addition, according to the ECB study, four out of ten people paid less frequently with cash during the Corona pandemic and want to continue doing so in the future.

"Many long-held reservations about cashless and contactless payment have been permanently overcome, which opens up new perspectives and offers great further growth potential for digital payments – especially in the DACH region," says Hoffmann.